car lease tax deduction calculator

Your deduction would be 4750 9500 x 50 4750. Total lease payments deducted in fiscal periods before 2020 for the vehicle 0 2 Total number of days the vehicle was leased in 2020 and previous fiscal periods 184 3 Manufacturers list price 33000 4 The amount on line 4 or 39882 35294 4588 whichever is more 39882 85 33900 5 904 184 30 5545 6 33900 3000 33900.

Writing Off A Car Ultimate Guide To Vehicle Expenses

You can claim work-related expenses you incurred as an employee for a car you.

. You need to claim your deduction for these vehicles. In this case the formula will look like this. A leased car driven 9000 miles for business equates to a 5175 deduction 12000 miles 3000 personal and commuting miles 0575 IRS mileage rate.

Now add GST and PST to 800 and multiply that amount by the total number of days you leased your vehicle during the year and divide the total by 30. If youre an Armed Forces reservist a qualified performing artist or a fee-basis state or local government official complete Form 2106 Employee Business Expenses to figure the deductions for your car expenses. Leasing company car is more tax efficient than owning a car for salaried employees.

You can claim a maximum of 5000 business kilometres per car. I leased a new vehicle in July 2017. Schedule F Form 1040 Profit or Loss From Farming if youre a farmer.

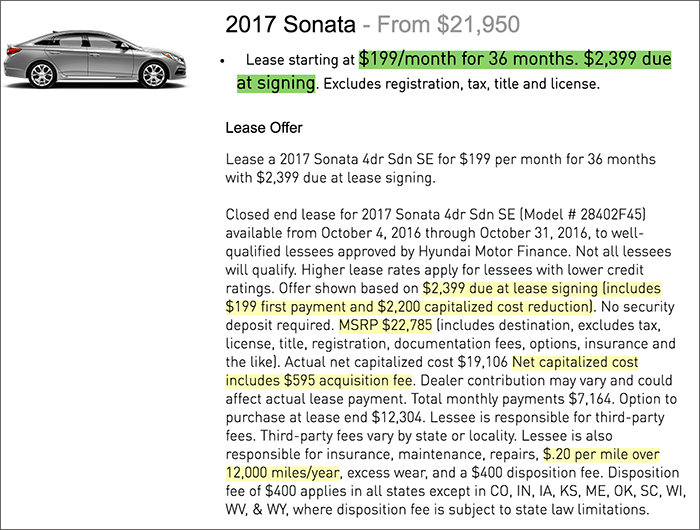

My monthly payment includes sales tax of 2453 total of 14958 for July - Dec. Normally we have seen a lot of salaried employees having several queries about the tax liability of owing a car and using it for both personal. The so-called SALT deduction has been around for a while and it allows eligible taxpayers to deduct certain state and local taxes such as property tax and income tax or sales tax.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Deducting sales tax on a car leaseIf you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxesThe so-called SALT deduction has been around for a while and it allows eligible taxpayers to deduct certain state and local taxes such as. The IRS allows you to deduct the following actual car expenses.

Answer If you lease a car you use in business you may not deduct both lease costs and the standard mileage rate. Vehicle Expenses 7000 x 60 4200. 35294 GST 1 and PST or HST 1 on 35294 5.

It can be used for the 201314 to 202021 income years. Either by calculating actual expenses or by using the standard mileage rate. For example lets say youre in sales and drive your car 16000 miles in 202112000 miles for business and 4000 miles for personal use.

Enter the total number of days the vehicle was leased in the tax year and previous years 3 4. If you claimed your lease payments last year subtract last years amount line 20. 800 13 x 181 30 5454.

Enter the manufacturers list price 4 5. If you drive for Uber or Lyft any costs related to making your ride more passenger-friendly would qualify. Other possible write-offs include fuel insurance oil changes and repairs.

Leasing a vehicle could help you save as much as 30 on your taxes. His total deduction in 2021 are. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

Qualifying vehicles must have had a gross vehicle weight rating of over 6000 lbs. The lease amount you pay for a vehicle is eligible for tax relief. To calculate your deduction you multiply the number of business kilometres the car travelled in the income.

This is the total selling price of the car before taxes. 1 Depreciation Licenses Gas Oil Tolls Lease payments. As a business you have two options for how you determine the amount of your car lease tax deduction.

Deduct the standard mileage rate for the business miles driven. If you choose this method you must use the standard mileage rate method for the entire lease period including renewals. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or Oregon.

If youre in a 25 tax bracket you will save 13050 in taxes. Is this all I can deduct or can I deduct the sales tax for the entire 36 month term of the lease. Which car lease write-off method is.

Your car lease isnt the only expense you can claim under this method. The deduction is large because the actual expenses are large. Deduct your self-employed car expenses on.

For instance the rate for the 2016 tax year is 54 cents per mile see Publication 463 for. Vehicle Cost 80000 x 60 48000. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase price of a new Nissan truck or van purchased and placed in service in 2021.

Enter the total lease payments deducted for the vehicle before the tax year 2 3. That means you could claim 75 12000 16000 of the cars expenses as business expenses. Car leasing and taxes.

Total Pre-Tax Selling Price. Total vehicle annual running cost minus the FBT employee contribution 5800 GST on the above 5800 580011 527 The before-tax deduction is 5800 minus the GST of 527 5273 52 weeks 10140. This includes a Nissan Titan and NV Cargo Van.

When trading in a vehicle the final amount used to calculate the sales tax amount is lowered by the value of your trade-in. Enter the total lease charges payable for the vehicle in the tax year 1 2. In the example above the actual expenses include.

Right now you can use the BankBazaar website to lease a car from Revv. Great now you know how to do it. To calculate how much will be deducted before tax you need to do two separate calculations.

Car lease options in your city. Enter this number on line 24. Simply put you can take a flat-rate deduction for every business mile driven in your rented vehicle.

Youd multiply that percentage by what you actually paid on your car expenses. Deducting sales tax on a car lease. 1000 gas 1500 insurance 6000 lease payments 400 repairs 100 oil 500 car washes Standard Mileage method.

Car Lease Calculator - Simply the Best Auto Lease Payment Calculator Pricing Details MSRP Selling Price Before Incentives Cash Incentives Selling Price After Incentives Residual value. A car your own lease or hire under a hire-purchase arrangement. Enter the value that a dealer is giving you for your current vehicle.

Leasing a car differs from a commercial hire purchase under which the interest and depreciation is tax deductable. To calculate the deduction for professional use of your car using the standard mileage method simply multiply your business miles by the amount per mile allocated by the IRS. Under work-related car expenses in your tax return.

This is known as the State And Local Tax SALT deduction which also allows for real estate taxes property taxes and other sales taxes write offs. Total deduction 52200. This is applicable for self-employed as well as salaried professionals.

Also there was a sales tax charged on the capitalized cost reduction two separate sales tax charges of 18224 and. Eligible vehicles include cars station wagons and sport utility vehicles. I itemize my deductions.

Lease Car Through Your Business Tax Calculator Uk Tax Calculators

Quickly Figure Out If Your Lease Deal Is Good

Novated Leases And Fbt Explained

Is Your Car Lease A Tax Write Off A Guide For Freelancers

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Are Car Lease Payments Tax Deductible Lease Fetcher

How To Deduct Car Lease Payments In Canada

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Can You Reduce Your Income Tax With Salary Packaging Easi Novated Lease Fleet Management

Novated Lease Calculator Atotaxrates Info

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Car Expenses You Can Deduct For Tax

Section 179 Tax Deduction Port Orchard Ford

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values